Posts by Payroll Complete

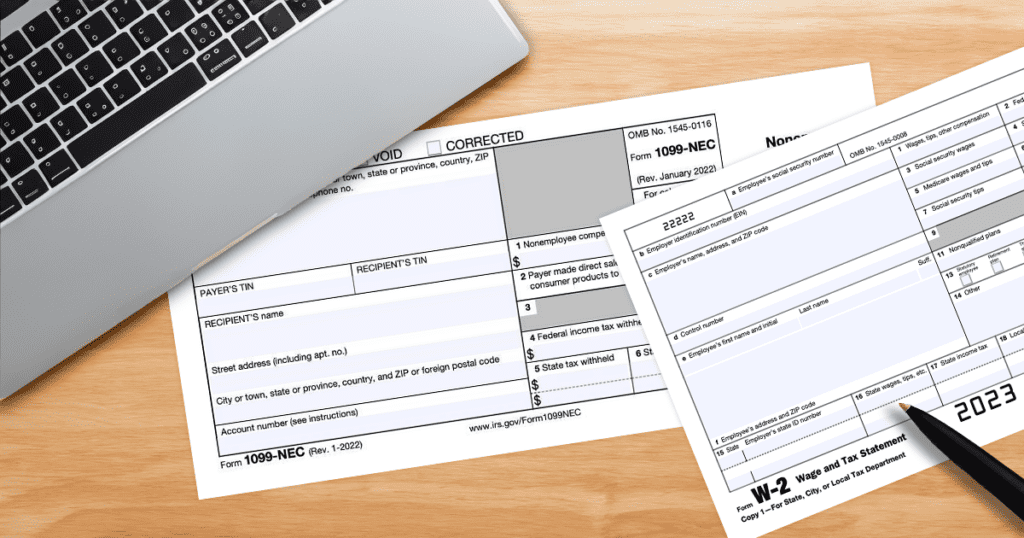

W2 vs. 1099: Unpacking the Important Key Differences

In today’s working world, it’s vital to grasp the distinctions between “W2 vs. 1099,” whether you’re an employee or an employer. This article will clarify the main differences and offer insights to help you make informed choices for your business. W2 Employee: The Conventional Path Definition: A W2 employee is a vital part of a company’s…

Read MoreEmployee Retention Credit terminated early by the Infrastructure Investment and Jobs Act

Article Highlights: Infrastructure Investment and Jobs Act (IIJA) Signed into Law Employee Retention Credit Terminated Early Problem for Some Employers No Relief Included for Employers Already Claiming the Credit in the 4th Quarter Recovery Startup Businesses Still Qualify President Biden signed the Infrastructure Investment and Jobs Act (IIJA) on November 15, 2021. One of the…

Read MoreYOUR PPP LOAN FORGIVENESS WILL PROBABLY BE LESS THAN ANTICIPATED

Article Highlights: Paycheck Protection Program (PPP) Loan Terms Loan Amount PPP Loan Forgiveness Reduction in Pay Decrease in Employees Qualified Expenses Limitation Documenting Forgiveness Now that you have gotten a Paycheck Protection Program loan (PPP), it is time to start planning how to spend the loan proceeds so some portion of the loan will be forgiven.…

Read MoreHow hiring a payroll service can help you avoid the 3 most common mistakes made by employers

Hiring the right payroll service can not only help you avoid these costly mistakes, but it can save you money in the long run.

Read MoreDistinguishing Between Independent Contractors or Employees – Don’t Let Mislabeling Cost You!

Employers have several tax obligations related to their employees. The government expects employers to withhold income taxes and social security and Medicare taxes from their employees’ pay in addition to paying unemployment tax on their wages. On the other hand, employers have no tax obligations on payments they make to independent contractors. Whether or not…

Read More