When most business owners think about payroll compliance, they picture tax filings, W-2s, garnishments, and deductions. And while it’s true that payroll compliance is about checking all those boxes, what many overlook is the cost of getting it wrong.

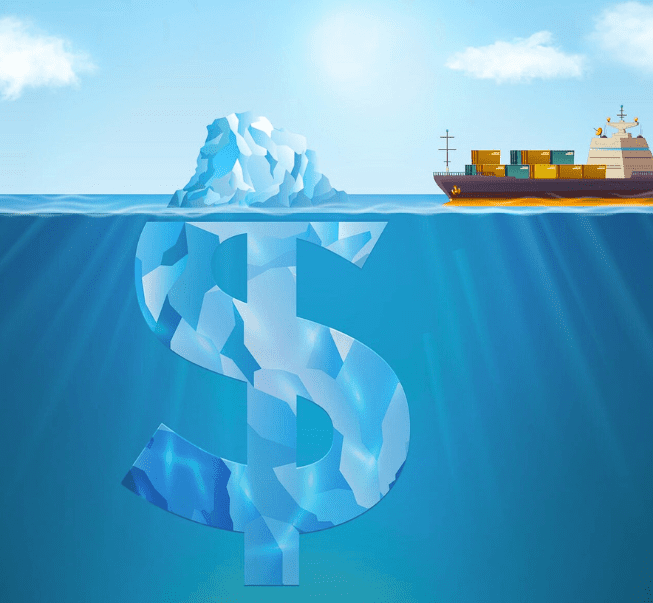

Payroll mistakes can feel small in the moment—one late tax filing, one miscalculated paycheck—but the true cost runs far deeper than a few extra forms. The financial, operational, and reputational damage caused by compliance missteps can quietly eat away at your profits and your peace of mind.

Let’s break down the hidden costs of payroll compliance errors and how your business can steer clear of them.

Beyond Fines: The True Price of Payroll Non-Compliance

Everyone knows the IRS charges penalties for late filings or unpaid taxes. But that’s just the surface. The real, day-to-day costs of poor compliance include time, trust, and lost productivity—costs that rarely show up on your balance sheet, but hit your business where it hurts.

According to OEM America, businesses lose thousands annually not just to fines, but to avoidable errors, corrections, and employee dissatisfaction.

1. Time and Distraction from Core Business Activities

Every payroll mistake pulls your leadership, HR, and finance teams away from their real work. Correcting errors, communicating with agencies, and responding to employee complaints can sap hours—if not days—of productivity.

2. Employee Frustration and Turnover

Pay errors or late paychecks can crush employee morale. In some cases, errors may result in personal financial hardship for employees, making trust hard to rebuild.

3. Legal Risk and Lawsuits

Non-compliance with wage laws, benefits deductions, or tax filings can expose your company to audits, lawsuits, and settlements.

4. Damage to Your Reputation

In today’s connected world, payroll errors can make it onto Google reviews, job boards, or social media. That kind of reputational harm can hurt recruiting, retention, and your standing in the community.

Common Payroll Compliance Mistakes (and Why They Happen)

Even well-meaning businesses fall into compliance traps, often because they:

- Misclassify employees as independent contractors.

- Fail to process garnishments correctly.

- Miss deadlines for quarterly tax filings.

- Overlook changes in local, state, or federal tax laws.

- Underestimate the complexity of multi-state payroll compliance.

Whether you handle payroll in-house or through a provider, compliance needs constant attention, ongoing training, and system checks.

How to Avoid the Hidden Costs of Payroll Compliance Mistakes

✔ Build Internal Checklists and Processes

Use technology and checklists to ensure tasks like tax filings, benefit deductions, and garnishments are done timely and correctly.

✔ Stay Informed

Laws change constantly—especially at the state and local levels. Regular compliance reviews with your CPA or payroll provider are essential.

✔ Choose Reliable Payroll Partners

If you outsource, make sure your payroll service takes compliance seriously. Learn more about how reliable providers ensure timely and accurate payroll in this guide.

✔ Proactive Employee Communication

Keep employees in the loop if something goes wrong—and act quickly to correct errors. Transparency is your best defense against eroded trust.

Red Flags That Compliance May Be Slipping

- Employees frequently report paycheck errors.

- Garnishments or benefit deductions aren’t processed consistently.

- Your payroll team is always in “fire drill” mode at tax time.

- You receive tax notices from agencies before your payroll team alerts you.

These signs aren’t just annoyances—they are costly warnings that something is off.

Final Thought

Payroll compliance is often treated as a back-office function, but the hidden costs of getting it wrong can derail your business. From lost time to damaged reputations, non-compliance is simply too costly to ignore.

Whether you handle payroll in-house or partner with a provider, make sure compliance is front and center—not an afterthought. When done right, payroll becomes a tool for trust, retention, and financial stability.